|

Ever feel like you’re doing everything right — refining your entries, optimizing indicators, sticking to your plan — yet you're still getting inconsistent results?

It’s common to put in hours, tweak every detail, and still struggle to see consistency. The real issue isn’t discipline or mindset — it’s methodology.

Most traders react to price patterns, levels, past moves instead of reading context.

A trend strategy works in trends but fails in ranges.

Knowing where the market is likely to move or reverse is what separates guesswork from precision.

Relying on specific time frames or chart types can be misleading. They may help but often add subjectivity and limit real-time insights.

Time frames are tools, not true reflections of market dynamics. Price action stays constant, only our perspective changes.

The V-Zones Method works with this reality, providing flexible, context-driven analysis for more accurate, consistent trading decisions.

Introducing the V-Zones Trading Method

Years of market research and trading led to a structured, proprietary approach that delivers real consistency, without the noise.

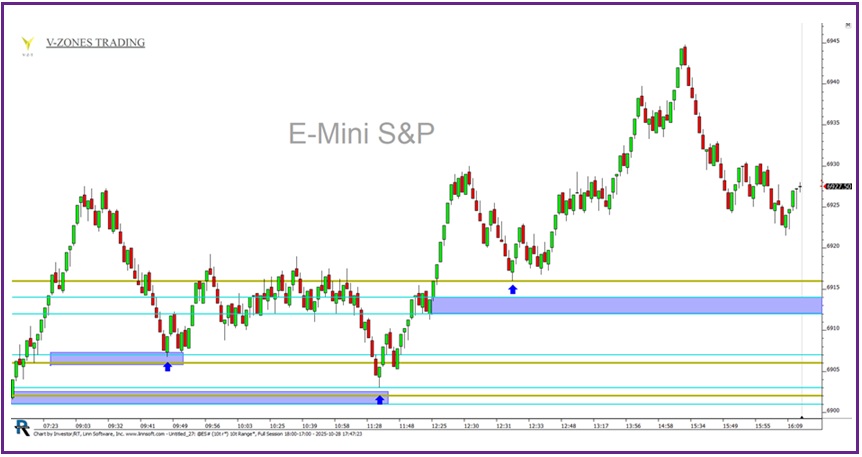

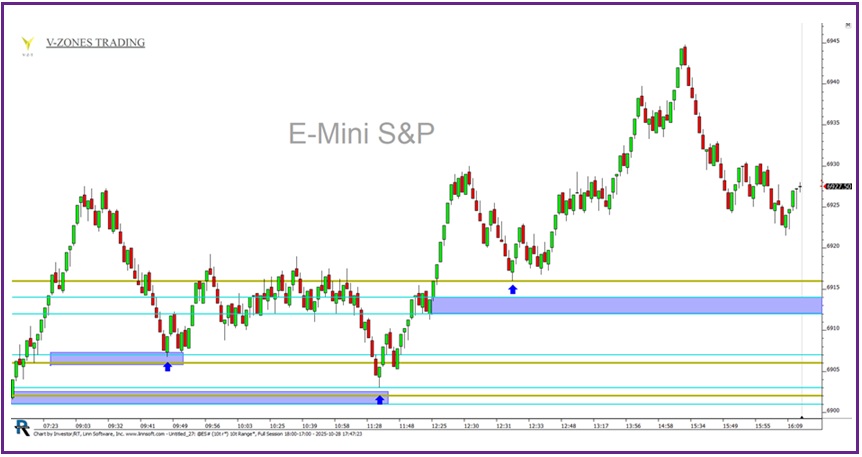

The V-Zones Method redefines how traders approach Supply & Demand by using two proprietary techniques to pinpoint where institutional activity truly drives price.

This dynamic, data-driven approach creates a precise trading map, identifying exact zones where markets are likely to pause or reverse.

I’m opening it up to 25 more traders ONLY— with a limited-time offer you won’t want to miss

In THIS short video, the exact method taught since 2010 is broken down — a results-driven approach trusted by traders who value performance over noise.

Learn more by CLICKING HERE to View a short 5 min Video

If the old ways aren’t delivering consistent results, this could be the shift you’ve been looking for.

|